WE RECENTLY PRESENTED our analysis of the Philippine economy until 2030 using the De La Salle forecasting and simulation models. Our assessment tilts toward the moderately optimistic side of the scale, barring unexpected shocks. Growth will continue, wages and income per capita will increase, the very thin middle class is also slowly increasing, and poverty will decrease.

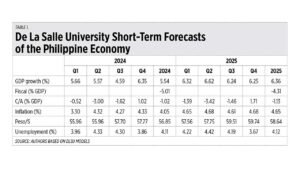

Having said the above, our analysis shows that the Philippines will not do as well as the government keeps saying over and over. This means that the key targets set in the Philippine Development Plan (PDP) 2023-2028 will be attained a few years later, including income per capita which is said will be attained by 2028. The economy will grow, but not at 6.5-8%. It will register an average of 5.5% between now and 2030, with a peak of 6.4% in 2025. Poverty will decline, but will not reach 9% until 2035 (2028 in the PDP), and its hypothetical elimination would take several decades. At the same time, the macroeconomic situation is stable (again, barring shocks), with unemployment declining toward 4% and inflation staying close to the ceiling of the central bank’s target range of 2-4%. We also see the Peso depreciating and reaching P62 per dollar in 2027 and remaining there. The latter is not necessarily bad news as the economy will eventually adjust to this rate; and moreover, while initially imports will become more expensive, exports, and tourism, will become more price competitive.

The picture summarized in previous paragraphs reflects steadiness. The problem is that behind it there is what we call MOTS, or “More Of The Same.” Calls to further liberalize foreign direct investments (FDI) or improve the ease of doing business might be fine but these will not put the economy on a high-speed train. We are in the caboose. We have said it before: the country needs firms that manufacture high-quality products and export them, that is, compete in world markets.

Unless the structure of our economy changes in the direction of industrialization, progress will continue but at today’s pace. The reason? About 50% of our employment is in activities of low productivity, such as agriculture, wholesale and retail trade, and construction. This structure does not change significantly in our baseline scenario forecast until 2030. This is the main reason why gross national income per capita increases slowly and remains below the government’s target: it will reach $5,919 in 2028 against the PDP target of $6,044 to $6,571. Under our baseline scenario, it will take many more years than most think to get to high income or catch up with economies like Malaysia, not to mention with the advanced Western economies. This is probably a chimera.

Moving forward to 2026-2030, growth will peak in 2025 (6.4%) and 2026 (6.2%) but then it will decrease toward 5-5.5% until 2030. Why does this happen? The reason is that it is very difficult to maintain for years a growth rate at potential, which is about 6-6.5%. For the Philippines to grow (actual growth) above this rate, the potential rate will have to increase, and this will happen only with a “different” economy. With the current engines, this is the fastest we can advance, not 7-8%.

Our models allow us to design a hypothetical scenario where we travel faster. In this scenario, the manufacturing employment share increases to about 25% of total employment between now and 2030. This would accelerate growth to 8-10% until 2030 (East Asian style) and would bring gross national income per capita to about $7,406 in 2028 and to $8,777 in 2030. This is the only way.

Of course, in reality, the share of manufacturing will not reach 25%. The manufacturing employment share today is just 8% (and declining), though it is true that the number of workers in the sector is increasing but at a much slower pace than in other sectors (hence the decline of this sector’s share in total employment). Yet, the exercise is meaningful in that a 25% manufacturing employment share was the share that all advanced economies attained in the 20th century. Reaching this share was a necessary precondition to attain high income. Our model is consistent with this assessment.

What can the Philippines manufacture? This is simple: the thousands of products that make a national economy and that today we do not manufacture or do not export competitively (as high-quality products). Instead, we import them: canned processed fruits and vegetables (agriculture); table napkins (textile sector); cutlery (metal sector); glasses (chemical sector); chairs, tables, and beds (furniture sector); or top-of-the-line ball pens, pencils, and erasers. And we do not manufacture the machines that make these products. If Filipino companies cannot manufacture these products competitively, “let’s close the country.” Do not look for funny growth drivers. Artificial intelligence and similar stories? No, that is not what will propel the Philippines today.

We also simulate what would happen if the employment share of Accommodation and Food increased to 15-20% by 2030. This is where most workers in the tourism sector are. Again, this will not happen, but the exercise tells us that income per capita would be lower than in the baseline scenario (at $5,319). Why? It is a low-productivity sector.

There is no choice but to industrialize, however difficult it may be. The Philippines missed its chance in the 1970s, 1980s, and early 1990s; and even today, many government officials and private sector CEOs believe that what the Philippines needs is recipes such as further liberalizing FDI, spending more on infrastructure, or reducing red tape. We do not claim that these are not necessary. What we claim is that these measures will not contribute to significantly change the structure of the economy. They amount to doing MOTS, perhaps somewhat better but no more.

In the case of much-desired FDI, the evidence for most developing countries is that it is detached from the local economy. There is no correlation between the position in the Doing Business ranking and growth. Yet, do not talk to some policymakers about “industrial policy” — measures to propel the manufacturing sector. They make faces. Instead, the focus on “servification” has become a mantra.

Naturally, services do contribute to the economy. The problem is that a significant portion of our services is non-tradable (does not compete in the world economy). Business Processing Outsourcing certainly contributes, but that sector’s share in total employment is small in a county with almost 50 million workers. We do recognize the sector’s contribution from the balance of payments point of view. We do hope this sector moves up the development ladder and enters the activities that pay higher wages.

Tourism could also lend a hand, but the Philippines will — for sure — not accommodate 40 million tourists by 2030. Where will they stay? Not to mention that our island-tourism type is not sophisticated. And even if the share of employment in agriculture declined by a few percentage points and that of tourism increased (as it will happen), the corresponding increase in productivity and wages would only be a fraction of that attained if the employment share that increased was that of manufacturing.

Finally, the other important contributor to maintaining the balance of payment is OFW remittances. That we have almost 2 million workers abroad is a sign of the weakness of the economy. The good news is that we forecast that this number will decrease to 1.4-1.5 million by 2029-2030. This is the result of higher wages at home.

In conclusion: our analysis shows that the Philippine economy will continue improving until 2030. Hence, the glass is half full and we are moderately optimistic. The big question is the direction and speed of the economy in the coming years: where is it going? We argue that unless the structure of the economy changes and manufacturing plays a much more important role (becomes a bigger employer), we will continue being part of the caboose. Either we focus on creating firms that transform our economy (increase productivity and manufacture products that compete in the world economy), or the Philippines will be left behind in the coming decades.

Jesus Felipe is distinguished professor of Economics at De La Salle University. Pedro Pascual is a board-certified economist with Spain’s Ministry of Economy and partner at MC Spencer (Philippines).