For this column, I will cover three recent important local events in the energy sector, then look at global trends in the gas trade.

First, I went to the Power 102 forum on July 10 at the Seda Hotel BGC organized by Aboitiz Power Corp. (AP) and their partner Manila-based journalists. It drew a big audience — about 60 reporters and journalists from Metro Manila and provincial media, both print and broadcast, covering energy stories.

The opening remarks were given by Ronald “Suiee” Suarez, Vice-President for Corporate Communications of AP. Said the soft-spoken engineer: “AboitizPower started this power lecture series in 2023 with a goal to help energy journalists in their professional development by increasing their understanding of an important yet very complex industry. As a follow-up to last year’s Power 101 seminar on energy policies and pricing, Power 102 tackled the challenges of growing variable renewable energy capacity in the Philippines in the context of a dynamic regulatory and technological environment to secure a resilient and reliable grid. We hope that our media guests learned a lot from the various speakers, from Department of Energy (DoE) Secretary Raphael P.M. Lotilla and Undersecretary Rowena Guevarra, ERC (Energy Regulatory Commission) Chairperson Monalisa Dimalanta, and private energy companies, local and foreign, that came. We trust that we will see them again in future runs of this education series.”

Then there was the Manila Electric Co. (Meralco) press conference on July 15 regarding the July 2024 electricity rates. It was announced that there was a significant increase of P2.15/kilowatt hour (kWh) mainly due to a higher generation charge as power costs normalized following the artificially low rates of last month. The overall rate for a typical household went up from P9.45/kWh June 2024 to P11.60/kWh in July.

Meralco Vice-President and Head of Utility Economics Lawrence S. Fernandez correctly explained that “[distribution utilities] like Meralco pass-through the actual costs of generation. In the past couple of months, generation costs rose, reflecting the Yellow and Red Alerts we experienced and the tight supply situation. We hope this rise in generation charges provides an adequate price signal for additional generation capacity, including expediting permits and approvals for power plants and contracts.”

Aside from the substantial increase in the generation charge, two other things were notable in the July 2024 rates. One, the transmission charge by the National Grid Corp. of the Philippines (NGCP) went down by P0.155/kWh, and two, taxes (VAT, local franchise, etc.) have increased by P0.175/kWh.

That was a good move by the NGCP. They finished three big projects — inaugurated by President Ferdinand Marcos, Jr. — this year: the Mindanao Visayas Interconnection Project (MVIP) which was ceremonially energized on Jan. 26; the Cebu-Negros-Panay interconnection in Bacolod City, which was inaugurated on April 8; and the Mariveles Hermosa San Jose interconnection in Bataan which was inaugurated on July 12.

The third was the Energy department’s response to various newspaper reports on “PH dependency on coal-fired power surpasses China and Indonesia” which it made on July 10. I share the arguments of the DoE that “the power generation mix of the Philippines cannot be directly compared with large economies like China and Indonesia… China has an installed coal power plant capacity of 1,136.7 gigawatts (GW), Indonesia has 51.6 GW, while the Philippines has only 12.1 GW.”

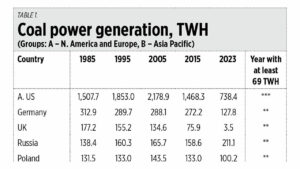

I put together a table showing the absolute coal power generation in terawatt-hours (TWh) of several countries, not the percent share of total generation. The Philippines’ coal generation of 69.5 TWh in 2023 was already attained by Vietnam in 2018, by Indonesia in 2011, by Taiwan in 1998, by South Korea in 1995, by Australia and Canada likely in the 1970s, by China, India, Japan, Russia, and the UK likely in the 1940s to 1960s, and by the US perhaps since the late 1800s (see Table 1).

Instead of people demonizing our coal plants, we should in fact expand our coal generation capacity especially in Iloilo, Cebu, and Mindanao via “brownfield” coal investment, the expansion within existing facilities which will no longer require new environmental clearance certificates (ECC), and which are not covered by the DoE’s coal plant moratorium order in 2020.

GLOBAL LNG EXPORTS UNDER TRUMPRelated to global energy supply and prices as a result of US energy policies, I checked the expansion of global liquefied natural gas (LNG) exports. From 358 billion cubic meters (bcm) in 2016 as the baseline, it jumped to 393 bcm in 2017 which was former US President Donald Trump’s first year in office, up to 490 bcm in 2020, his last year in office.

Good thing that President Joe Biden sustained the momentum initiated by Trump — the US’ LNG exports continued rising to 114 bcm in 2023. Australia and Russia also expanded their LNG exports, but it was the US that made a big difference (see Table 2).

The Philippines can take advantage of this rising volume of LNG exports from more countries. Our existing gas plants which currently rely on Malampaya gas, and the new big gas plants that will soon start operating and will run on imported LNG will have more choice when it comes to LNG sources — from the US, Qatar, Australia, Malaysia, Indonesia, and even Brunei. Coal and gas expansion in the country should help augment our energy security and, by extension, our economic security and growth momentum.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.