THE PHILIPPINES could lose as much as $1.89 billion (P107.6 billion) in exports of mostly mechanical and electrical equipment to the US if President Donald J. Trump makes good on his threat to impose higher tariffs, according to a House of Representatives think tank.

The amount could fall to a net loss of $1.6 billion due to so-called trade diversion benefits, the Congressional Policy and Budget Research Department (CPBRD) said in a report released this month.

“A common feature of these products is that they currently benefit from minimal to zero US tariffs, making them particularly vulnerable to the imposition of higher duties,” CPBRD authors Mark Carmelo R. Manguera and Dawndale Albert O. Tanilon said in the 38-page discussion paper.

The CPBRD report examined the potential impact of the US tariff pronouncements on the Philippines under a second Trump administration.

The United States was the top destination for Philippine-made goods in 2024, with exports valued at $12.12 billion or 16.6% of total export sales.

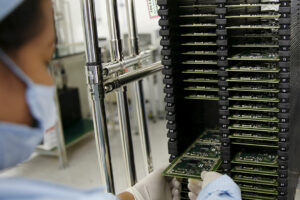

According to the CPBRD, majority of Philippine export products expected to have negative net trade effects due to higher US duties are manufactured goods.

It noted that eight out of the 10 sectors fall within the category of mechanical and electrical machinery, equipment, and parts, while the remaining sectors — crustaceans and mollusks, and coconut and palm kernel oil — are classified as primary commodities.

Mr. Trump, who assumed office on Jan. 20, has already slapped an additional 10% tariff on Chinese goods, but delayed a 25% tariff on goods from Mexico and Canada for a month. This is part of his broader “America first” trade policy which seeks to prioritize US economic interests.

Mr. Trump has also threatened to impose reciprocal tariffs on every country that sets duties on US imports, a move that would affect the Philippines.

“The most significant decline in Philippine exports is projected for discs, tapes, solid-state non-volatile storage devices, smart cards, and other media for the recording of sound or of other phenomena, with a reduction of $386.7 million,” the CPBRD said.

Philippine exports of coconut and palm kernel are expected to decline by $374.5 million, while exports of automatic data processing machines are set to drop by $187.6 million.

Exports of electronic machinery, particularly electric transformers, static converters and inductors, would also drop by $143.5 million.

Philippine exports of telephone sets, including smartphones and other transmission network devices, are expected to fall by $130 million.

“Other products that would be heavily affected by the US tariffs are in electronic integrated circuits ($97.82 million); machinery parts and accessories ($77 million); insulated wire, cable, other electric conductors, and optical fiber cables ($74 million); monitors and projectors ($64 million); and crustaceans, mollusks, and other aquatic invertebrates ($63 million),” the CPBRD said.

POSITIVE EFFECTSOn the other hand, the CPBRD said there could be positive trade diversion effects for certain export products, such as apparel and footwear.

“This is reminiscent of the ‘bystander effect’ during the US-China trade clash, where some third countries were able to take advantage of shifts in trade dynamics… However, in terms of value, the net trade gains are relatively modest,” it said.

The biggest projected positive net trade effect for the Philippines is in lasers, which is expected to jump by $37.3 million, while exports of seat parts are projected to rise by $18.2 million.

Trade in Philippine-made suits, jackets, trousers and dresses may increase by $17.3 million, while casual clothing products, such as jerseys and cardigans may jump by $17 million.

Women’s clothing, such as skirts and trousers, could also see a $13-million increase.

Other product categories to anticipated to post gains include knitted or crocheted garments ($12.79 million); cement, concrete or artificial stone ($12.73 million); men’s suits, ensembles, jackets, blazers, trousers, bib and brace overalls, breeches and shorts ($12.52 million); festive, carnival or other entertainment articles ($11.8 million); and electro-magnets ($10.93 million).

“To navigate the challenges posed by potential changes in US tariff policies, the Philippines must address both immediate and long-term barriers. Diversifying export markets by strengthening trade relations with alternative countries may reduce reliance on the US, while pursuing preferential access to the US market can help sustain existing trade flows,” the CPBRD said.

The Philippines should also try to minimize the adverse effects of US tariffs by exploring new markets and “capitalize on trade diversion, particularly from China, India and Indonesia,” it added.

“For the top five products that would be negatively affected by the US tariff pronouncements, China, Hong Kong, and Germany emerge as prominent global importers,” the CPBRD said, referring to discs; coconut; automatic data processing machines; electric transformers; and telephone sets.

“By focusing on these markets, the Philippines can strengthen trade and investment missions and explore opportunities to negotiate trade agreements, thereby enhancing access and competitiveness in these markets.”

The CPBRD said the Philippines should also “intensify negotiations” with the US for the reauthorization of its Generalized System of Preferences (GSP).

“The reauthorization of the GSP would effectively shield covered products from the tariffs that would be imposed by the US,” it said.

The think tank said the government should also leverage Republic Act No. 11981, or the Tatak Pinoy (Proudly Filipino) law, which aims to improve the country’s position in the global value chain by encouraging companies to make quality products.

“An opportunity for the country lies in the timely and effective formulation and implementation of the Tatak Pinoy Strategy… which aims to identify target sectors and actionable measures for domestic industries to produce and offer increasingly diverse and sophisticated products and services,” it said.

The Philippines could further insulate its economy by forging more free trade agreements with Canada, Europe and countries in the Middle East, Calixto V. Chikiamco, president of Foundation for Economic Freedom, said in a Viber message.

“It can [also] focus on goods like minerals, which the US needs, and therefore can’t be subject to tariffs,” he added.

Mr. Trump’s tariff plans provide the Philippines an opportunity to build up its manufacturing industry, Leonardo A. Lanzona, an economics professor at the Ateneo de Manila University, said in a Viber message.

The state should now seriously consider a “national industrialization policy” and streamline state-led investments into the creation of nickel processing plants and renewable energy technology factories, Jose Enrique “Sonny” A. Africa, executive director at think tank IBON Foundation, said in a Viber message. — Kenneth Christiane L. Basilio