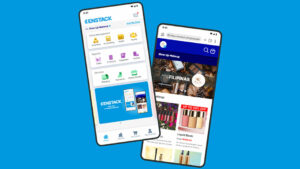

ENSTACK, a business management app, now allows small and medium business users to offer buy now, pay later solutions to their customers through lending platforms GGives and BillEase.

Under the feature, micro, small and medium enterprises (MSMEs) using the Enstack app can offer installment plans starting at P1,000 that can be paid over 24 months through GCash’s GGives and BillEase.

This is expected to provide smaller firms with more flexible and secure payment options, while improving buyers’ access to credit, it said in a statement.

“Giving merchants access to installment payments is a game changer for their business,” said Macy Castillo, co-founder and chief executive officer at Enstack.

“By enabling merchants to offer trusted pay later solutions, we’re helping them expand their customer base, including those who may not have the cash up front but are willing to pay in installments.”

Ms. Castillo said smaller firms have been unable to offer installment plans due to the lack of credit infrastructure, complex approval processes and additional fees.

On the other hand, large retailers can offer installment plans given their partnerships with banks and finance providers.

“This puts small and medium businesses at a disadvantage, as customers seeking installment plans often turn to bigger players with more accessible financing options.”

Through the buy now, pay later option, merchants can increase their average order value, attract budget-conscious buyers, and build stronger customer relationships,” Ms. Castillo said.

“With this partnership, Enstack is democratizing access to buy now, pay later for Filipino sellers, allowing even the smallest online shops to compete with major e-commerce players,” the company said.

Both GGives and BillEase are exclusively available to qualified Enstack merchants, unlike in other e-commerce platforms.

“At Enstack, we make it easier for merchants to grow by offering seamless, AI (artificial intelligence)-powered business solutions,” Ms. Castillo added.

Since its launch in February last year, Enstack has onboarded more than 200,000 entrepreneurs and has as many as 40 partners.

There are about 1.24 million MSMEs in the Philippines, according to the Department of Trade and Industry. — Beatriz Marie D. Cruz