(This article is based on the research undertaken by the Research Teams of Regina Capital Development Corp., a member of the Philippine Stock Exchange and Cristina Research Foundation, a public policy advisory company.)

On Oct. 30, the Hong Kong and Shanghai Banking Corp. (HSBC) issued a most unusual report on the Philippine economy entitled, “The Philippines takes off: From Stability to Prosperity.”

It was unusual in the sense that most economic reports deal prospectively with the coming year, while the HSBC report deals retroactively on the Philippine economy over the past 20 years. From that perspective, HSBC asserts that “Fuelled by demographics, digitalization, and services, two decades of reform have prepared the economy for take-off.” And therefore it predicts that “The Philippines will continue to grow in size and influence, creating many opportunities for foreign and local investment.”

This is welcome news for us, absorbed as we are on the trials and tribulations of the moment, not reflecting on how much progress we have achieved.

According to HSBC:

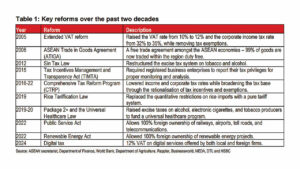

“The Philippines has built a solid runway for takeoff from two decades of hard-earned reform. Since the beginning of the 21st century, the country has embarked on a number of reforms, including the fiscal reforms and trade deals of the Macapagal administration, the Sin Tax and institutional reforms of the Aquino administration, the fiscal and infrastructure reforms of the Duterte administration, and the liberalization and fiscal reforms of today (see summary in Table 1). The country has laid a solid fiscal and economic foundation that could finance the long-term investments needed to lift its economic potential.”

We comment on the following reforms: the Extended VAT reform, the Sin Tax Law, and the Rice Tariffication Law.

The Extended VAT Reform was enacted in the face of a fiscal crisis then besetting the Philippines where the losses of the National Power Corp., among others, were endangering the fiscal stability of the Philippine government. At great political cost, then President Gloria Macapagal Arroyo and then Senator Ralph Recto pushed for the approval in Congress of the Extended VAT Reform Law. The law raised the VAT rate from 10% to 12%, the corporate income tax rate from 32% to 35% and removed certain tax exemptions, thus putting the Philippine government on sound fiscal footing up to this day.

The traditional approach to smoking and drinking is biblical. Those who engage in such activities are considered sinners who must do penance (pay sin taxes) and sin no more. Of course, it is not always clear if the aim is to save sinners or fill government coffers.

Our medical professionals, God bless them, proposed a less moralistic and more realistic framework. The activities of smoking and drinking pose increased medical hazards not only to those who smoke or drink but also to the rest of the population as well. For increasing the health care cost of the medical system, it is but fitting that they carry a heavier burden as enacted in the Sin Tax Law.

In 2024, the programmed contribution of sin taxes to the Philippine Health Insurance Corp., better known as PhilHealth, amounted to around P300 billion, an amount which will reduce the premiums that must be paid by the 113 million members of PhilHealth.

The Rice Tariffication Law is based on one simple economic fact: the price of international rice is roughly half the price of domestic rice. Our astute businessmen have always been aware of the arbitrage possibilities, i.e. import international rice and sell domestically. Admirably our government performed the role of equalizer. Under the Rice Tariffication Law, government allowed the importation of rice thus benefitting the 100 million Filipino consumers, while at the same time imposing an excise tax to be used to benefit the one million Filipino farmers who are adversely affected by the importation of rice.

The Bureau of Customs reported on Aug. 15 that since the start of the year, P29 billion in excise tax has been collected on imported rice or around P29,000 in assistance to each of our farmers.

As a result of these reforms, the HSBC report notes:

“The numbers speak for themselves in terms of their impact. Chart 1 shows that since the 1990s, growth consistently increased, inflation declined and became increasingly stable, interest payments shrunk, and gross reserves grew. The Philippines achieved macroeconomic stability.”

From the perspective of an AIM Professor in the 1990s, we now realize the economic progress the Philippines has made. In the 1990s, the Philippines was struggling to achieve a growth rate of 2-3%, now we assume growth rates of 5-6%. In the 1990s the Philippines experienced inflation rates of 10-12%, now we can aspire to inflation rates of 2-4%. Back then interest rates ranged from 12-18%, now they range from 6-8%, then the difference between the interest rate on Philippine government securities and the US 10-Year Treasury Bills was 14%, now it is around 1%. Finally, then our reserves of around $5 billion barely allowed us to meet our importation requirements, now with our $100 billion reserves, we have sufficient buffer not only for our importation requirements but also for our debt service requirements as well.

The HSBC report rightly credits our government officials for these economic reforms. But we argue that the private sector should share in the credit. Private sector groups did some of the policy reform studies and proposals, attended congressional hearings to expound on the benefits of the proposed laws, and provided the political and moral support for the politicians enacting the needed but politically controversial economic reforms.

One such organization is the Foundation for Economic Freedom (FEF) (Full disclosure: I am a Fellow of FEF). From its website, we learn of its history.

“The Foundation for Economic Freedom was established in 1996 by like-minded individuals who all believed that it is their civic duty to make the Philippines a better place. Formalized as an advocacy institution to engage in public diplomacy to enact free market-oriented change, it counts among its roster visible and well-respected business leaders, retired technocrats, and members of the academe. For over two decades, FEF has been the institution of reference for policies to transform the inward-looking Philippine economy into a trading one.”

Over its almost 30 years of history, it has been involved in legislation such the Residential Free Patent Act, the Electric Power Industry Reform Act, the Retail Trade Liberalization Act, the Rice Tariffication Act, and the Public Services Act, among others.

This work has achieved international recognition, with FEF wining the Asia Liberty Awards and the Templeton Freedom Awards.

Unacknowledged in the FEF website, probably due to his modesty, is the major role its president, Calixto “Toti” Chikiamco, played in making FEF what it is today. (His modesty will not deter me, his friend, from singing his praises considering I was present when he recreated FEF.)

Taking over as president in 2010 when FEF was in a financial crisis, he sought and successfully received grants from international funding agencies.

Once FEF was on sound financial footing, he invited a constellation of outstanding fellows to the cause, proving the adage that an outstanding leader is one who has the confidence to enlist people greater than him.

FEF has for its Board of Advisers, National Scientist Raul Fabella, former Prime Minister Cesar E.A Virata, former Socio-Economic Planning Secretary Gerardo Sicat, and former NEDA Director-General and Central Bank Governor Felipe Medalla.

FEF is currently led by its Board of Trustees composed of former Finance Secretary Roberto de Ocampo, OBE, as Chairman, and investment banker Simon Paterno as Vice-Chairman. Political economist Calixto Chikiamco is FEFs President, Ateneo University Chairman Bernadine Siy is its Treasurer, and lawyer Ricardo Balatbat Ill is its Corporate Secretary.

Other members of FEF’s Board of Trustees include competition lawyer Kristine Alcantara, Angeles University President and UP law professor Joseph Emmanuel Angeles, urban land planning expert Arturo Corpuz, information and technology law expert Jose Jesus Disini, government and regulatory affairs expert Christopher Matthew Ilagan, investment banker Vaughn Montes, real estate developer Jeffrey Ng, corporate lawyer Perry Pe, former Finance Undersecretary Ma. Cecilia Soriano, and former Finance Secretary Margarito Teves.

As President he rides herd over this group of raging incrementalists who do not allow the perfect to be the enemy of the good. In addition to being an enabler of reformers, Toti is himself an ardent reformer. He was the driving force and guiding spirit in the enactment of the Resident Free Patent Act. His central insight was that the issuance of land titles is not a judicial process requiring cumbersome court rules but rather a documentary process easily and quickly done by experts assisted by satellite photo technology. Prior to the enactment of the law, only around 4,000 residential land titles were issued yearly, now around 55,000 are issued yearly.

The judgement of HSBC on the bright prospect of the Philippine economy was confirmed by Goldman Sachs in its Nov. 17 report entitled, “Asia-Pacific Portfolio Strategy: 2025 Outlook: Navigating a more challenging macro mix:” The report over-weights its investment in the Philippines projecting that it will give the highest return of 19%. Moreover, the PSE Composite Index is expected to rise from 6,810 to 8,000 by December 2025.

Dr. Victor S. Limlingan is a retired professor of AIM and a fellow of the Foundation for Economic Freedom. He is presently chairman of Cristina Research Foundation, a public policy adviser of Regina Capital Development Corp., a member of the Philippine Stock Exchange.